Stripe vs PayPal – Which is Better?

Do you want to know which is better between Stripe and PayPal?

As an online business owner, the primary purpose of setting up your business is to make sales and earn money. But to do that, you need a payment processor.

The choice of a payment processor for your business depends on many factors, including its ability to integrate into your e-commerce platform, the type of transaction it supports, the cost of usage, and whether it has other features that you will need to run your business successfully.

When choosing a payment gateway, making the wrong choice can cost you customer loyalty and affect your bottom lines. So, you must take your time to do some research and make an informed decision.

The two most popular payment gateways are PayPal and Stripe. Most e-commerce and other online businesses use payment gateways to process payments on their websites.

In this article, we will compare Stripe vs PayPal by looking at the differences and similarities between both payment gateways so that you can make the best decision for your business.

What is Stripe?

Stripe is an online payment gateway that enables businesses to accept payments online from their customers.

As a payment processor, Stripe helps businesses to accept payments through various modes of payment. The payments are then deposited into a merchant account, where you can transfer them into your business bank account.

Stripe can be integrated into your website via APIs or a plugin such as ProfilePress if you are a WordPress site owner. Stripe offers many customization options, and this is why developers and code-savvy people like it because it has many integration options and can be customized to suit their purpose.

What is PayPal?

PayPal is one of the most popular and oldest online payment gateways. It is one of the most popular payment processors in the e-commerce industry, holding down 50% of the global market share.

PayPal started primarily as a digital wallet for individuals and small businesses. It is mainly used to send money to family and friends, issue client invoices, and receive payments.

However, PayPal has expanded its offerings, becoming one of the most used payment gateways for e-commerce websites, primarily due to its brand image and familiarity amongst online shoppers.

Stripe vs PayPal: Features and Services Comparison

PayPal and Stripe have a lot in common and a few differences. This section will dive deeper into the key features you should consider in your PayPal vs Stripe debate and then declare a winner for each category.

1. Transaction Fees and Cost

Transaction Fees

Before choosing a payment gateway for your business, you should consider the fees associated with such a payment gateway.

The fees being charged will ultimately affect your pricing and bottom-line profits. So, you must pay attention to this to avoid any surprises.

When it comes to fees, Stripe has a simple approach. Stripe charges a flat rate of 2.9% + $0.30 USD per transaction. This rate may vary from country to country, but it is always flat, thus making it convenient to calculate your costs and make proper decisions.

For PayPal, the fee calculations are not so simple. PayPal charges 3.49% + $0.49 USD per transaction and an additional 1.5% for international transactions. PayPal also takes some extra service fees here and there, which makes things a bit more complex, unlike Stripe, which charges a flat rate with no additional addon fees.

Micropayments

For micropayments (payments under $10). Stripe charges the same flat rate of 2.9% + $0.30, whereas PayPal charges 5% + $0.05 per transaction. As you can see, PayPal has a higher percentage fee for micropayments when compared to regular payments (3.49%).

Chargeback Fees

A chargeback fee is a fee incurred by your business when a customer disputes a card transaction at their bank, usually because of fraud or any other issues. If this transaction was performed on your website, then a chargeback fee is charged to your business.

Stripe has a chargeback fee of $15, while PayPal has a chargeback fee of $20.

Verdict: Stripe Wins.

Regarding fees, both try to offer competitive rates, but overall, Stripe is a cheaper option than PayPal for most businesses. The flat rate and lower percentages from Stripe give it an edge over PayPal.

2. International Transactions

If your business accepts international payments from around the world, then you should review the supported countries and currencies for both Stripe and PayPal.

PayPal is available in over 200 countries and supports 25+ currencies, while Stripe supports over 135 currencies and it is available in 47 countries.

Verdict: Tie

There are no winners or losers in this category. Your winner will depend on your business location and target market. Suppose your business is located in any of the supported countries by both Stripe and PayPal. In that case, you have to decide if you want to be available in more countries or if you want to offer more currency options to your customers.

3. Payment Options

Both PayPal and Stripe allow you to accept credit card and debit card payments on your website, but Stripe also supports a vast array of other payment types that you can integrate into your checkout system.

Stripe supports Alipay, Apple Pay, Google Pay, WeChat, Microsoft Pay, and more. Having a wide variety of payment options can be a great advantage to online stores because the more options available to the customers, the higher the chances of a successful sale.

Verdict: Stripe Wins

Stripe is a winner of this category because of its numerous payment options and extended card networks, giving your customers more payment options and flexibility at checkout.

However, because PayPal is quite popular and has a large customer base, it will be beneficial to have it available on your website for customers to use as an alternative to Stripe.

4. Customer Support

As a business owner, providing the best customer service is an important step to building customer loyalty and building a successful business. At some point in your journey, technical glitches will occur, especially with payments, and you will need to contact the customer support of your payment gateway. At this point, responsive customer service will come in handy.

You need to carefully choose your payment processor and be sure to pick one that offers prompt customer support and issues resolution when you need it.

PayPal offers customer support via phone, but not 24/7. PayPal merchants can also access support via email, live chat, or the community forum. Getting support from PayPal may require a bit of a wait time which may not be suitable for many business owners, especially when your customers are waiting for a quick resolution.

On the other hand, Stripe offers 24/7 customer support via phone, live chat, and email. Additionally, merchants can also get help by searching through the Stripe knowledgebase. The benefits of getting prompt customer customer support 24/7 can never be over-emphasized. It will allow you to get quick resolutions and keep your customers happy.

Verdict: Stripe Wins

Stripe winning this category is a no-brainer as they offer 24/7 chat and phone support, while PayPal support is only available Monday to Friday, 8.00 am to 8.00 pm central time. This makes Stripe a better choice when considering customer support.

5. Checkout Experience

Your website checkout experience is crucial to the buying process and should be evaluated closely. Your checkout experience could make or mar your sales and conversion rates as simple and fast checkouts improve conversions and reduce cart abandonment.

Stripe’s checkout experience is simple and clean. Your customers enter their credit card, click the submit button, and are taken to your order completion page or other follow-up page. Stripe provides a fast checkout and user-friendly interface, which can help reduce cart abandonment and boost conversion rates.

On the other hand, checkout becomes a little complicated with PayPal. To checkout with PayPal, you do not have the luxury of the onsite checkout process that keeps the customers on your website and keeps everything simple. Instead, a popup or a redirect is launched, and then they have to wait for it to load so that they can log in and start the payment process.

After the login, the customer still needs to choose from the various payment methods available, click to agree & continue, and then get redirected back to your website. All these extra steps and clicks reduce conversions and increase cart abandonment.

Verdict: Stripe Wins

Stripe’s simple and fast checkout process makes it a better choice for most merchants. The ability to checkout in one click can make a huge difference in your sales and conversion rates.

Stripe vs PayPal: Which is better?

The choice of the best payment gateway for you will depend on your business needs and the current stage of your business growth.

If you want clear pricing, a flat fee structure, fast checkout, and a better checkout experience go for Stripe. If you also want to process many international payments and currencies, then Stripe would be a better choice.

If you have a small business and want a quick setup, then go for PayPal, and if your market is primarily the USA with no international payments in sight, then PayPal is still a good choice.

Integrating Stripe With your WordPress Site

ProfilePress is an eCommerce and WordPress membership plugin that allows you to build powerful eCommerce websites with WordPress. It is one of the best WordPress payment plugins, and it offers a simple and easy way to start accepting credit card payments on your website.

ProfilePress allows you to accept one-time or recurring payments via PayPal and Stripe with support for email notifications, social login, email marketing, user management, and integration with other plugins such as Woocommerce.

The first step to integrating Stripe with ProfilePress is to install and set up the ProfilePress plugin if you do not have it on your website.

You will need to purchase a ProfilePress License and install the ProfilePress plugin.

After purchasing your copy of the ProfilePress Plugin, you will receive a confirmation email with a link to download the plugin zip file and your license key. You can also download the plugin from your account page on the ProfilePress website.

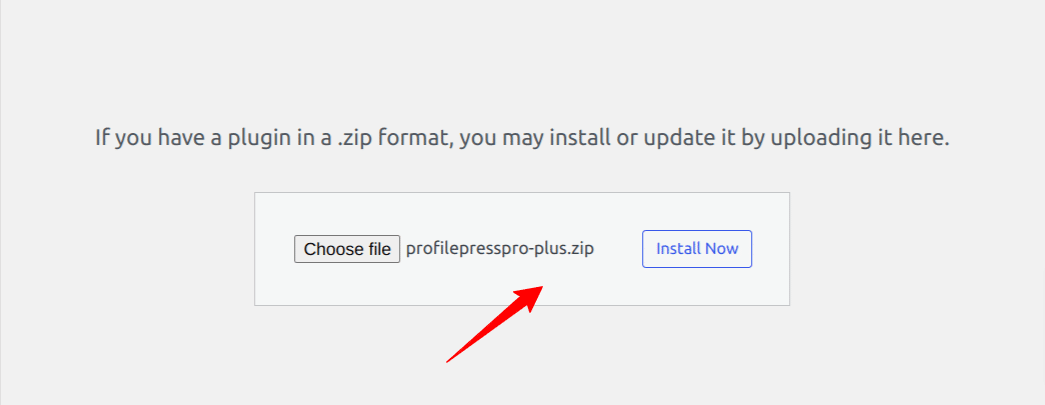

Once you have downloaded the plugin, login to your WordPress admin dashboard, and navigate to the Plugins page; click on the “Add New” button and click “Upload Plugin“.

Next, click “Choose file” to select the previously downloaded plugin zip file. Click “Install Now.”

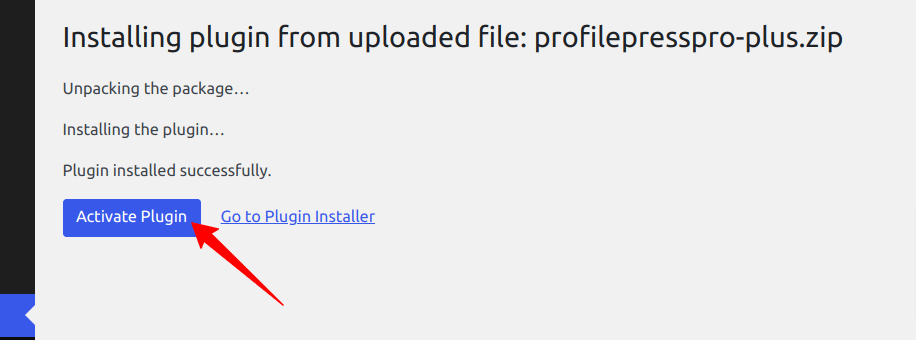

After installation is complete, click the Activate Plugin button.

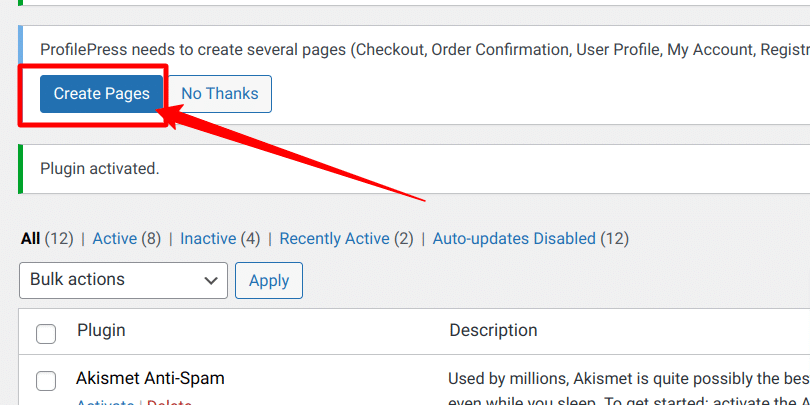

At the top of the page, you will see a notification that says, “ProfilePress needs to create several pages,” Click on the “Create Pages” button to complete the plugin setup.

If you do not see this notification, navigate to ProfilePress > Dashboard and click the “Create pages” button to complete the plugin setup.

With this done, we have completed the initial setup of the ProfilePress plugin on our WordPress site.

Connecting Your Stripe Account

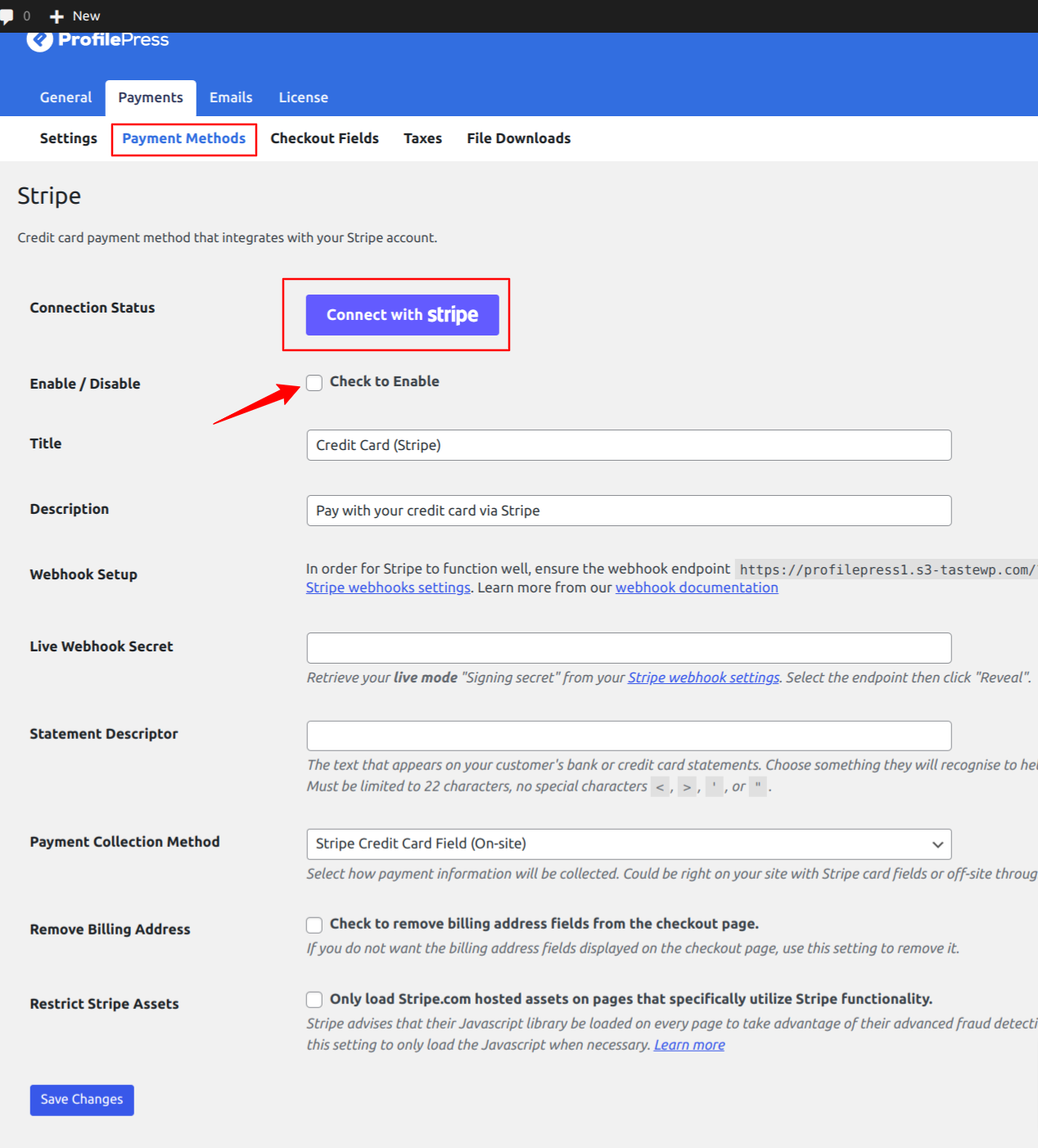

After the ProfilePress installation, the next step is to set up the Stripe Payment gateway for our WordPress payment forms. You can configure the Stripe payments on your site by navigating to ProfilePress > Settings > Payments > Payment Methods and choosing Stripe.

Click on the “Connect Stripe” button, follow the prompts, and you are all set to start accepting payments from your customers.

Integrating PayPal with Your WordPress Site

Like we did the Stripe integration, you can easily set up PayPal payments on your WordPress website using the ProfilePress PayPal Addon.

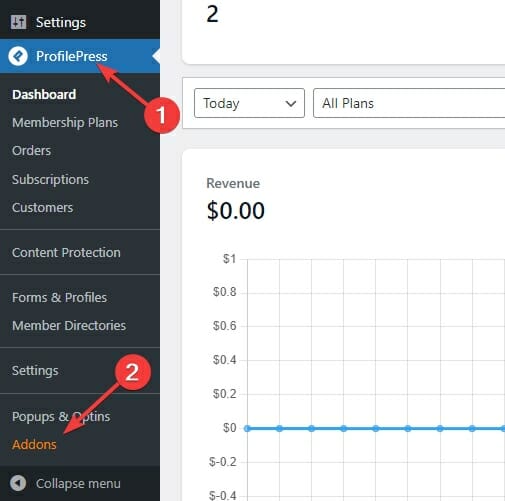

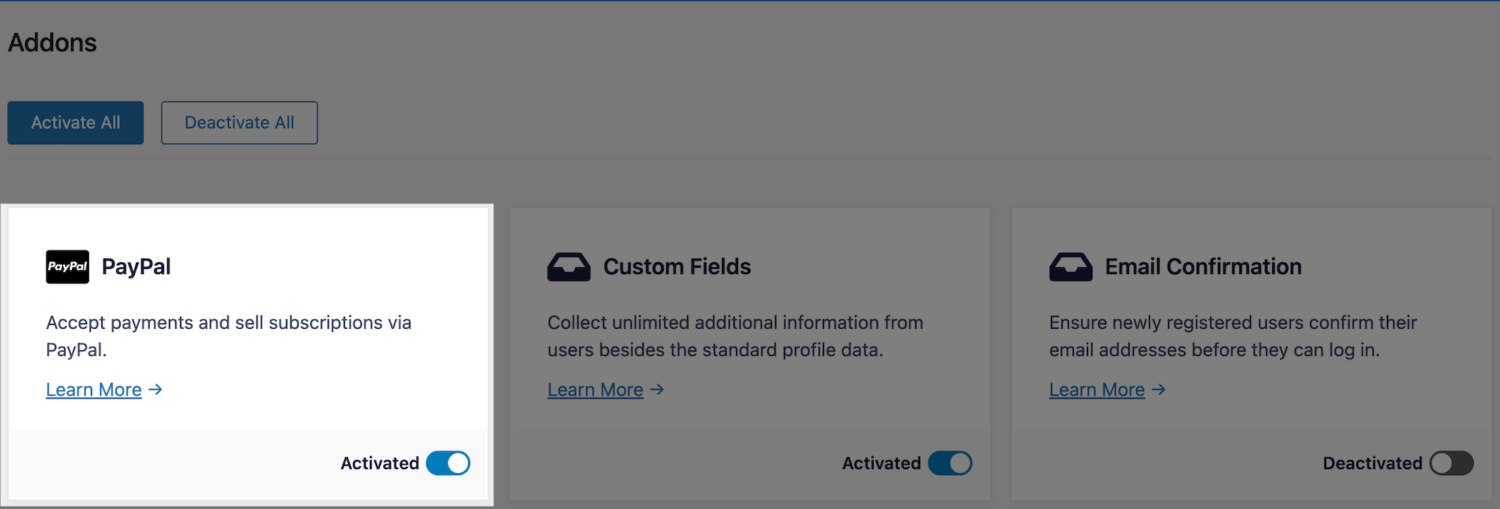

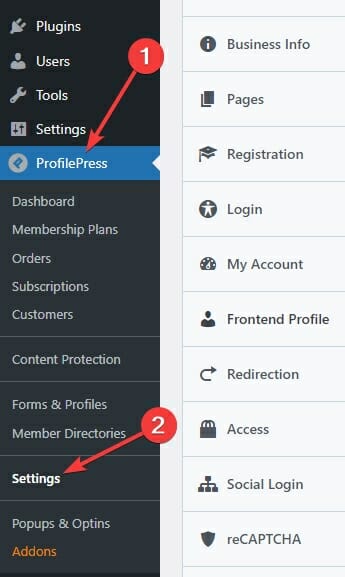

First, navigate to the Addons section of ProfilePress settings.

Now, enable PayPal payments by toggling the button, as shown below.

Next, navigate to the Settings section of ProfilePress.

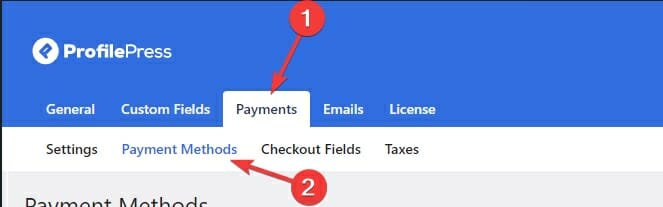

Now, go to the Payments tab and select the Payment Methods sub-tab.

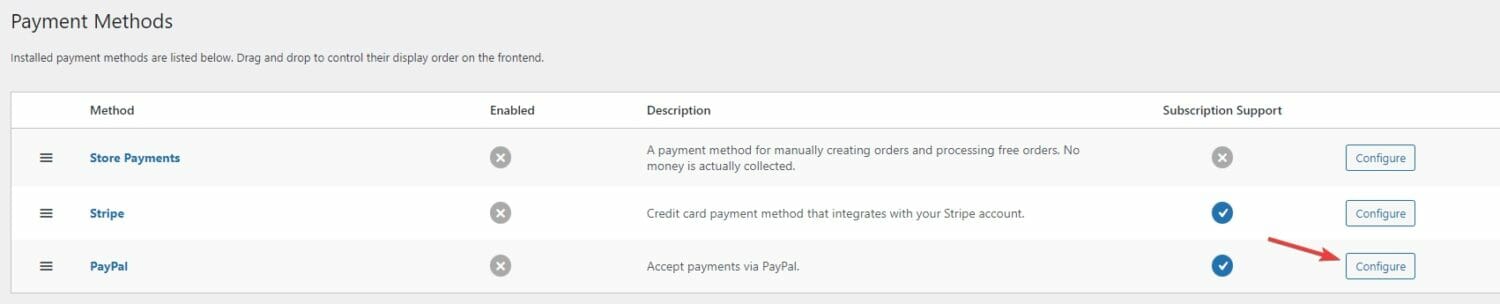

Click the Configure button next to the PayPal payment method option.

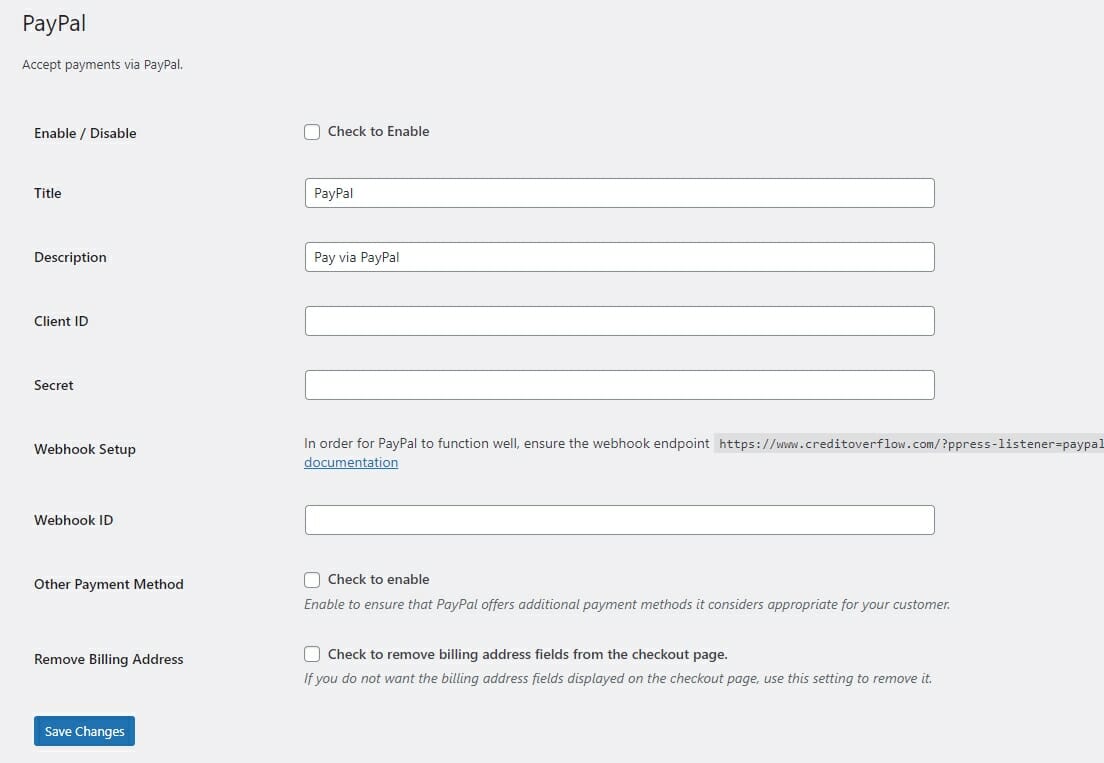

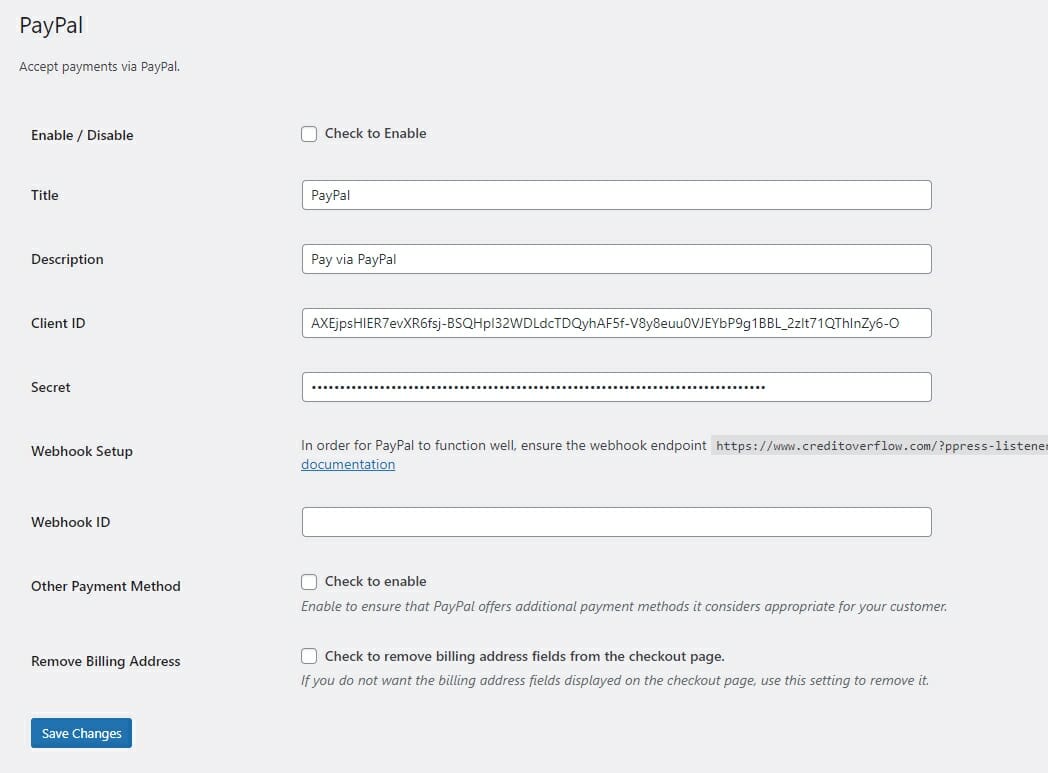

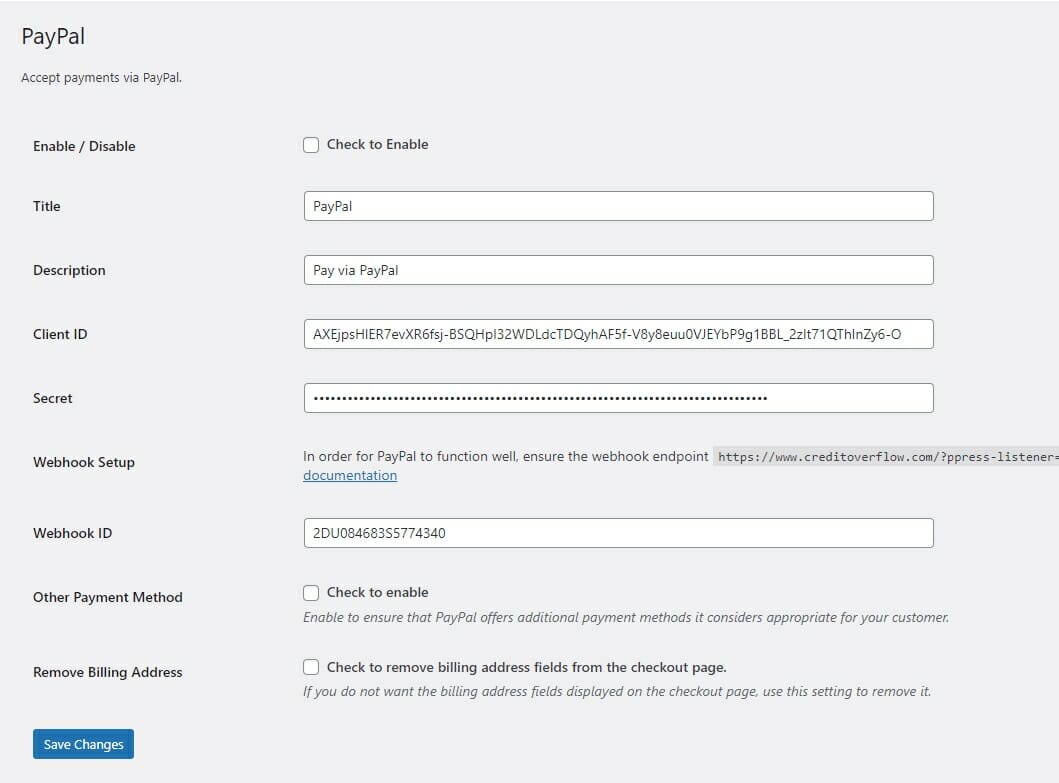

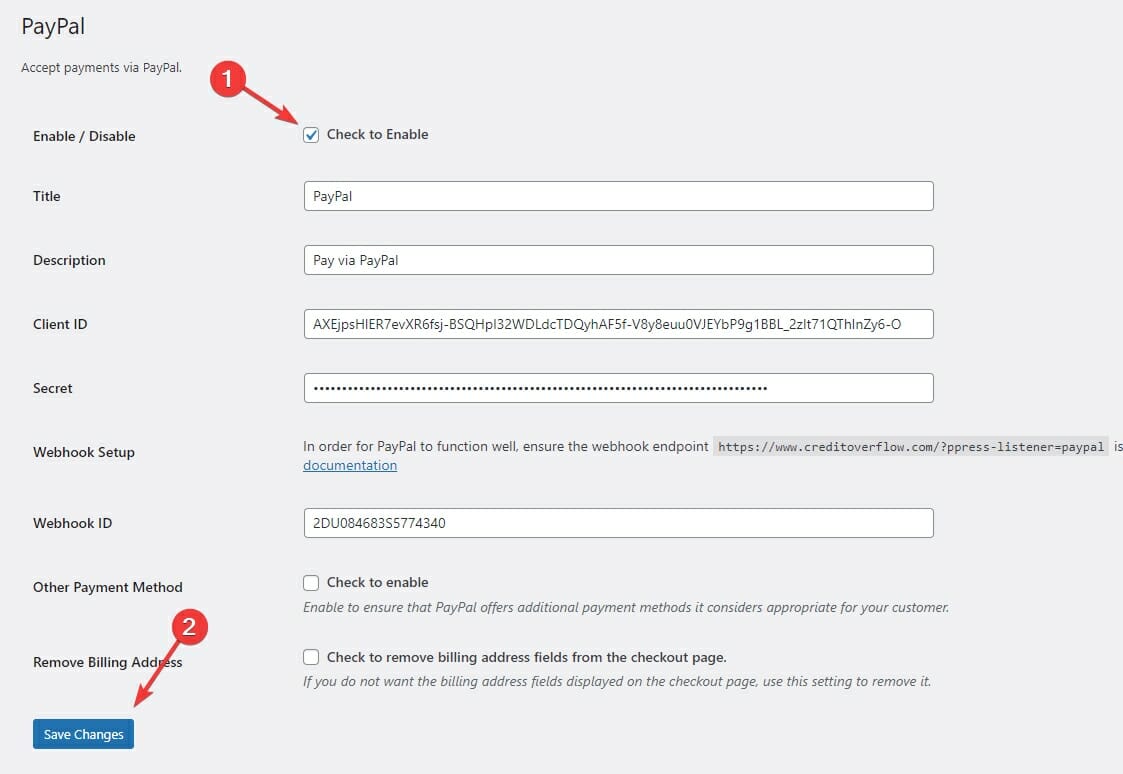

You will be taken to a page that looks like the image below.

You’ll need to supply all the required information on this page to enable PayPal payments. You need to provide your Client ID and Secret. Let’s see how to get them below.

Firstly, you need to create a PayPal app from their developer dashboard to complete the PayPal setup.

Visit the PayPal Developer platform and log in to your PayPal account.

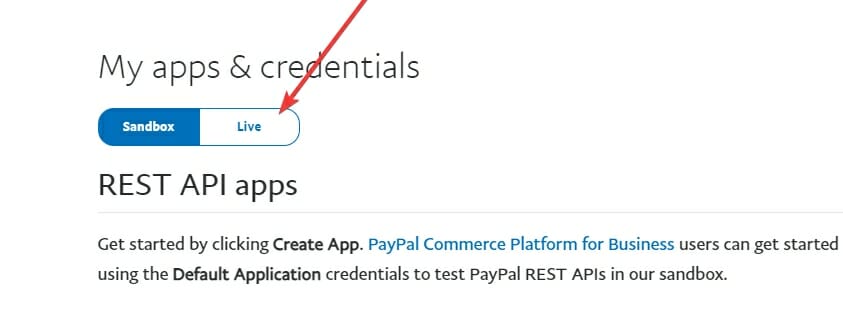

After logging in, select the Live tab.

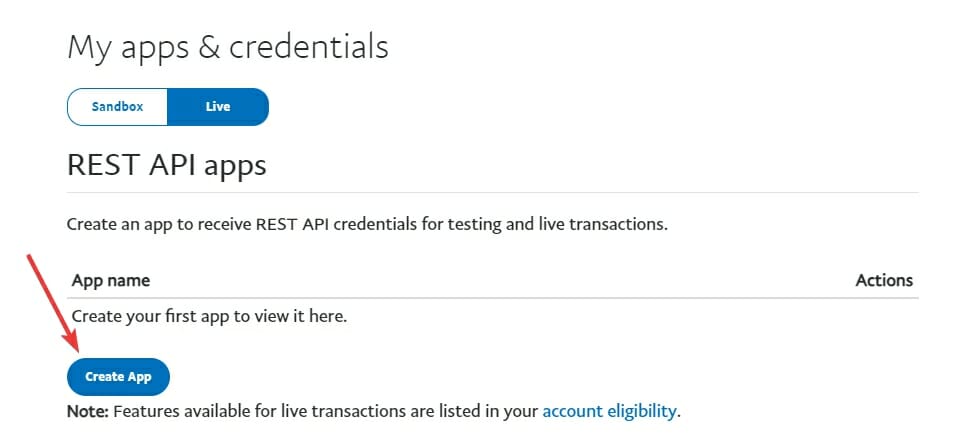

Next, click the Create App button.

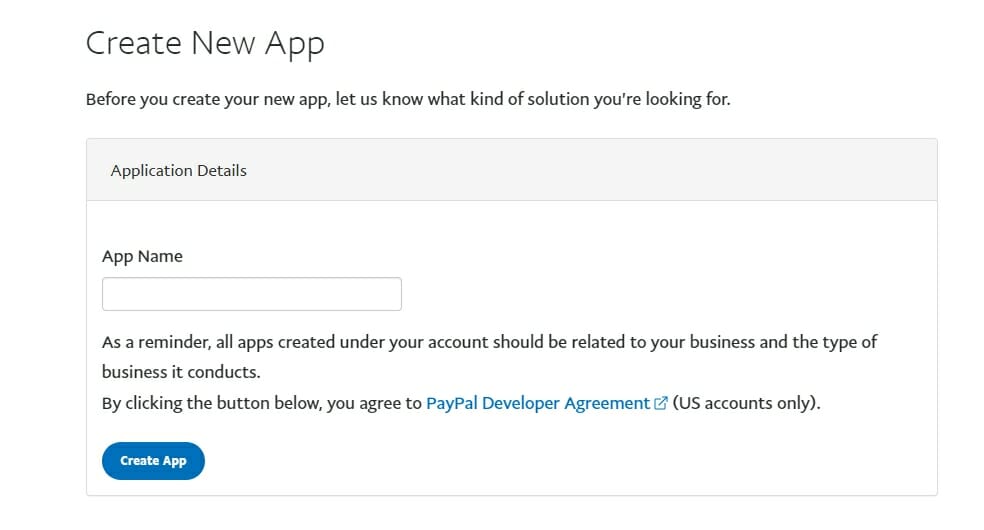

Give your app a name and click the Create App button.

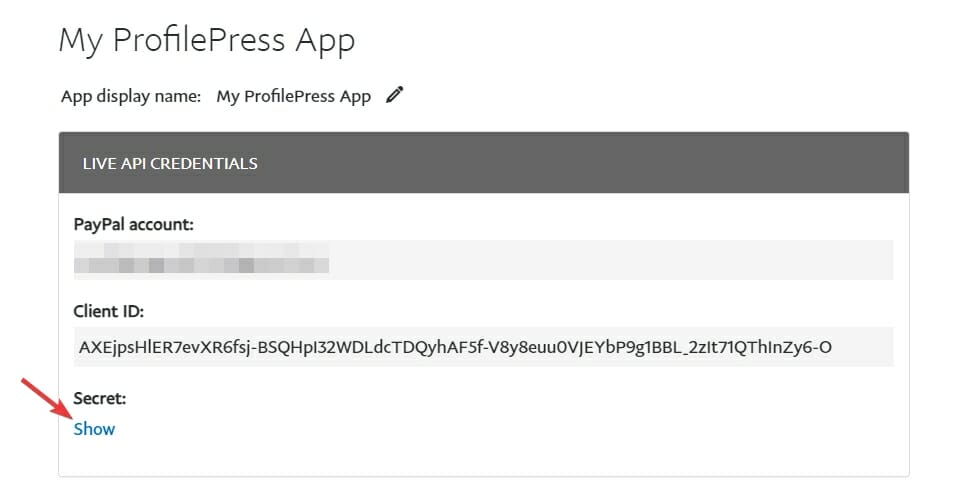

Now, you’ll be able to see your new App’s Client ID and Secret. Click the Show link next to Secret to see the secret key.

Copy the Client ID and Secret and paste them into your ProfilePress PayPal configure page.

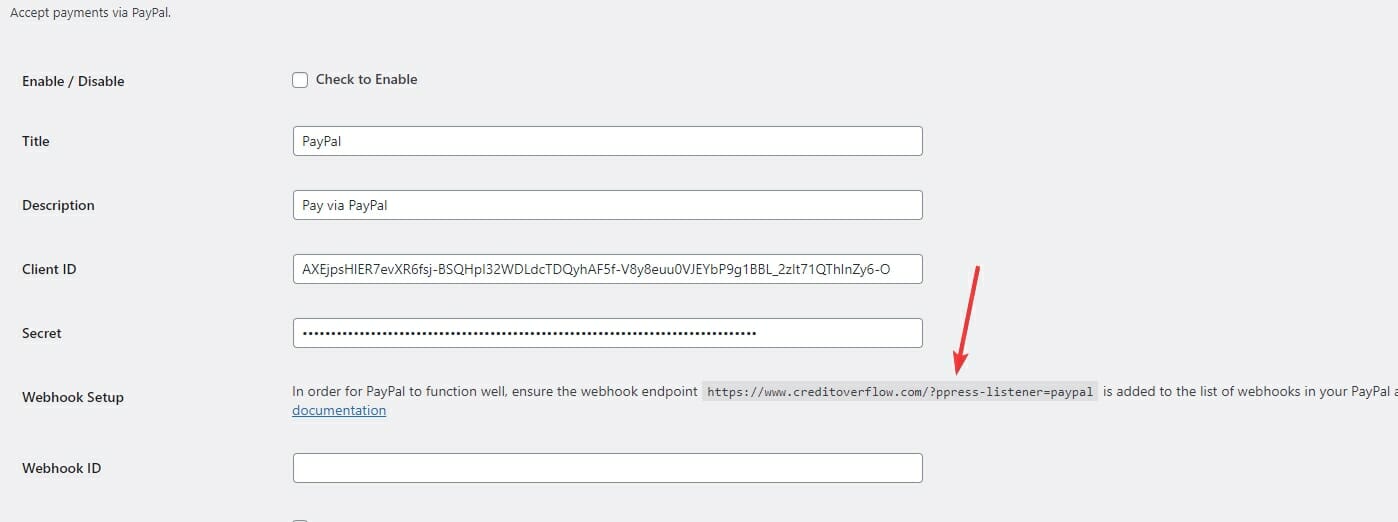

Next, copy the Webhook URL that you see on this page.

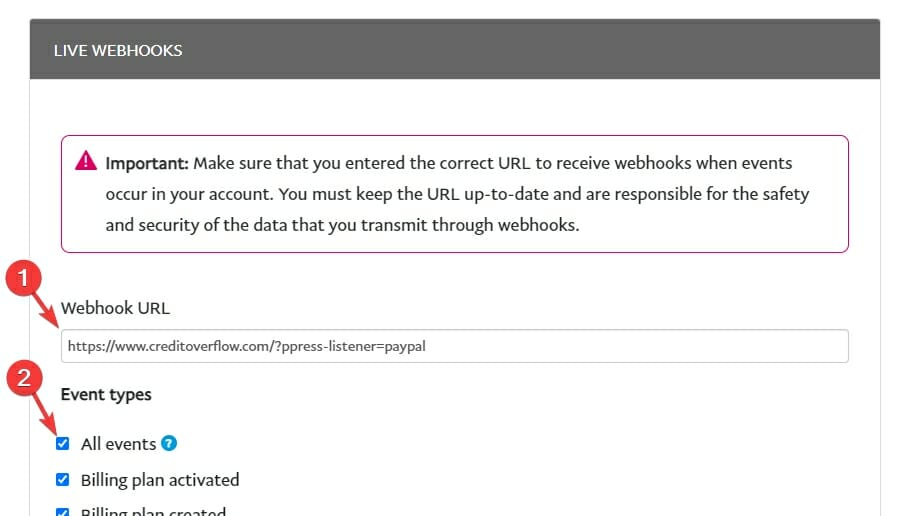

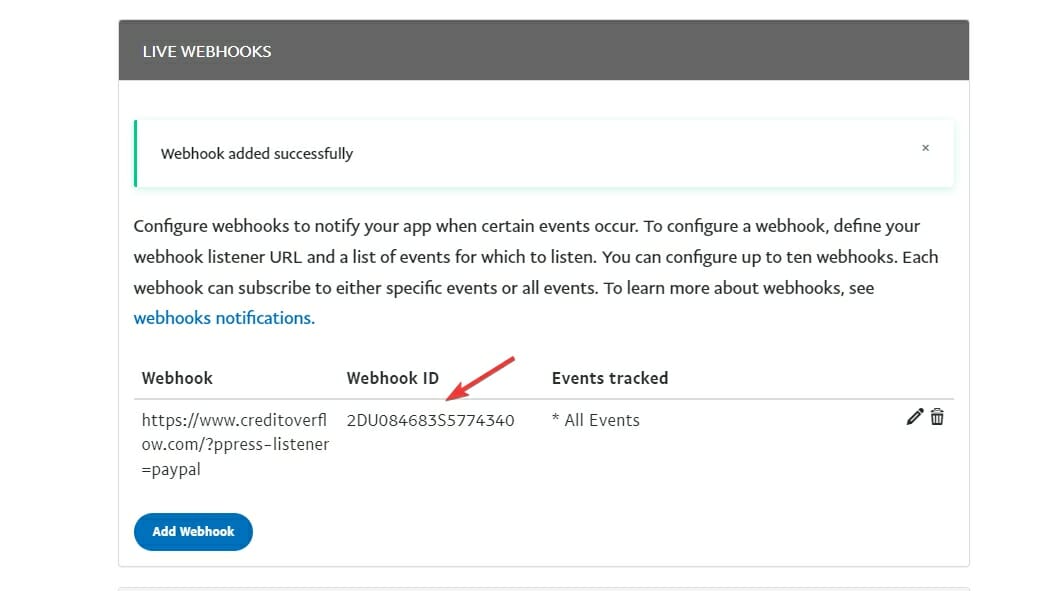

Return to your PayPal app’s configuration page, scroll down, and click the Add Webhook button. Then, enter the Webhook URL you copied.

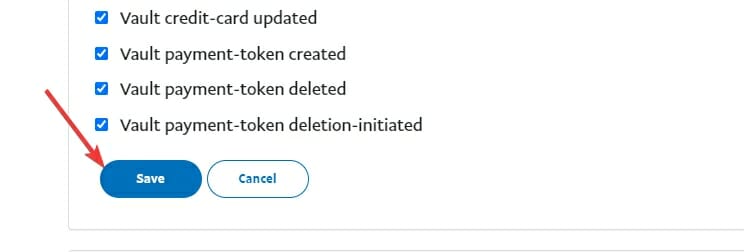

Scroll down and click the Save button.

Now, copy the Webhook ID for your newly created webhook.

Paste the webhook ID in PayPal integration settings and click the Save Changes button.

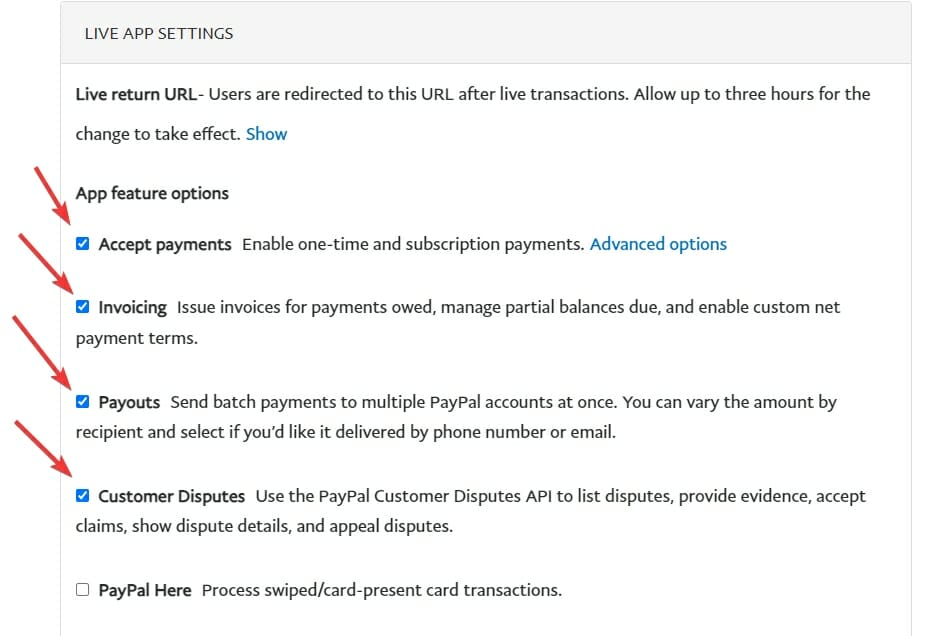

Now, scroll down to Live App settings and enable the first four options if they aren’t already enabled.

Finally, tick the Enable checkbox and click Save Changes.

That’s it! Your website is now connected to your PayPal account in ProfilePress.

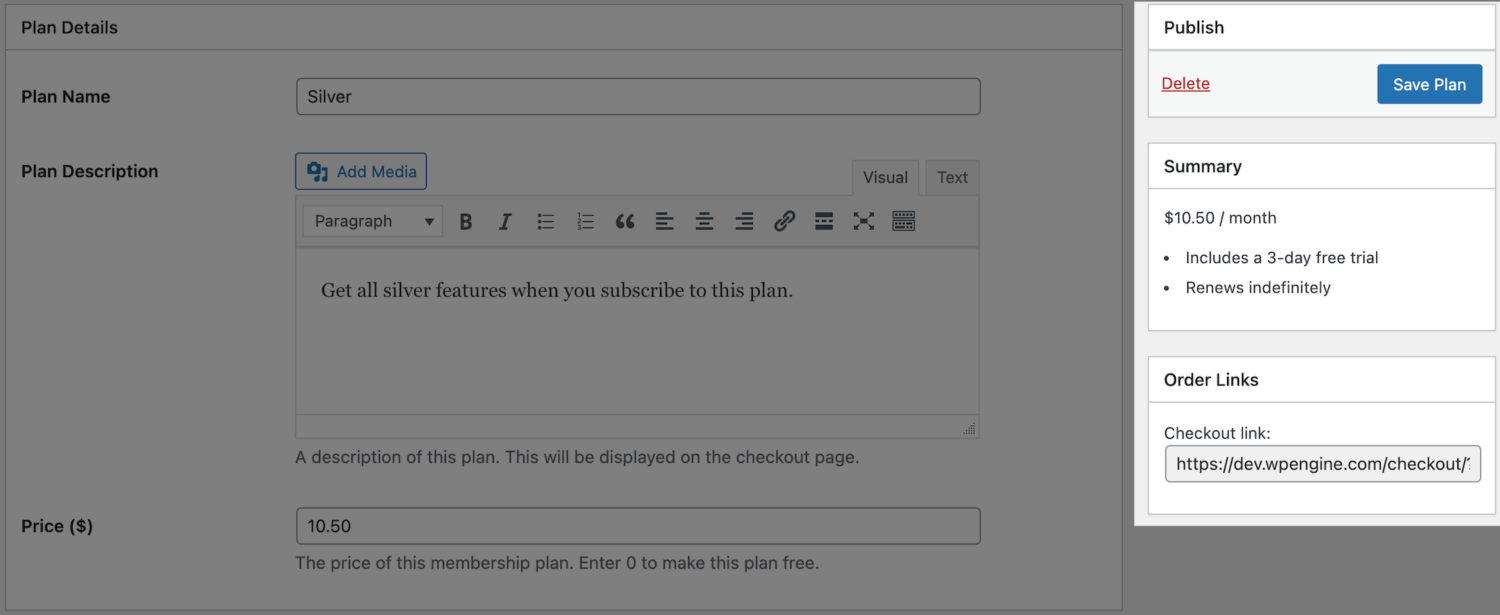

All that is left is to create membership plans to sell your digital products, memberships, services, online courses, and more.

You can then use the checkout URL of the membership plan to accept payment from your customers.

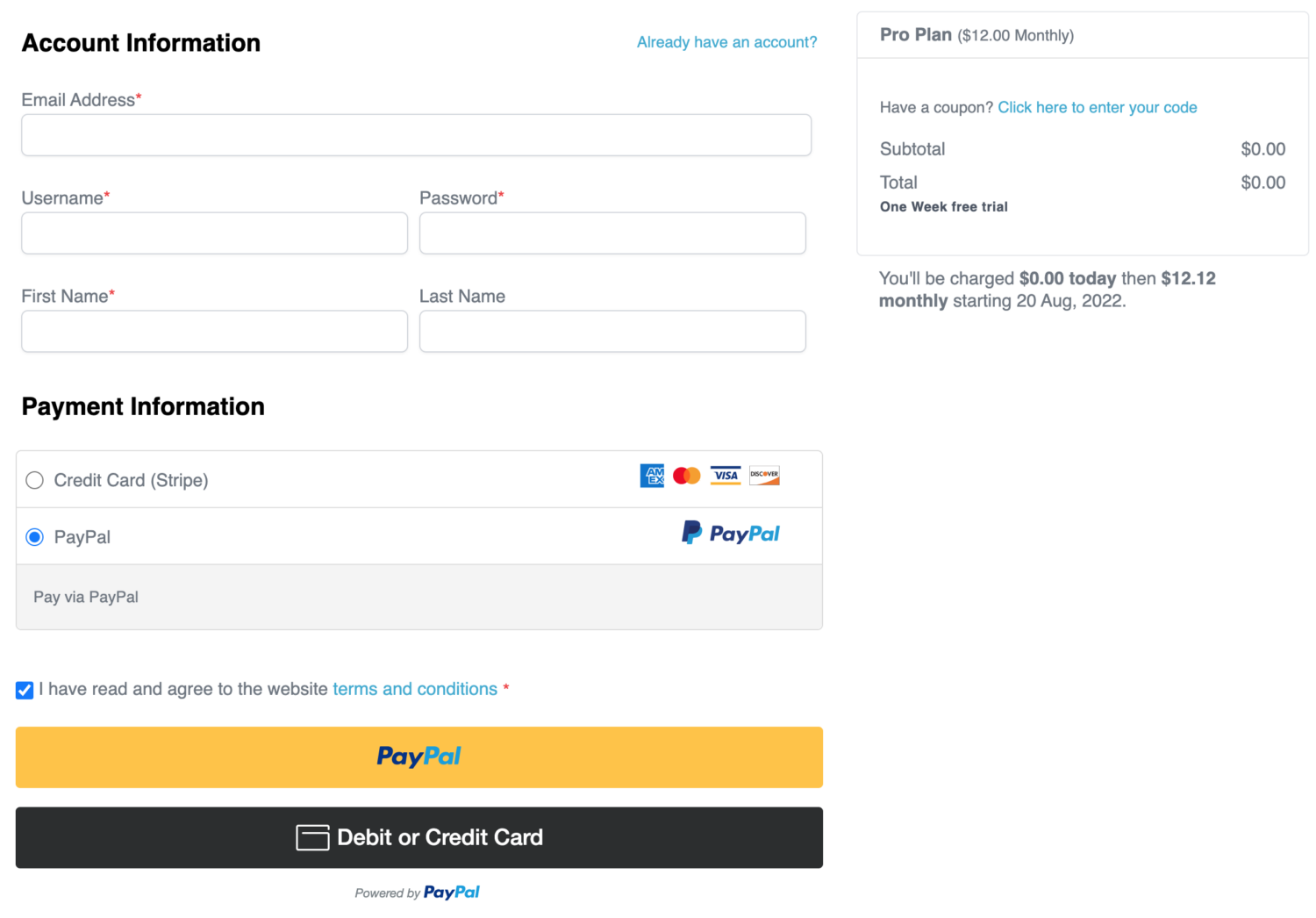

As you can see, accepting payments with PayPal or Stripe in WordPress is straightforward when using the ProfilePress plugin.

Conclusion

Both PayPal and Stripe are solid payment gateways for all merchants; they are similar in many ways, and it sometimes makes it challenging to pick one over the other.

Ultimately, your choice of a payment gateway will depend on your specific business needs, but a great hack is to support both payment gateway on your website and allow your users to choose their preferred one.